Board 8 > Stock Topic 24

| Topic List | |

|---|---|

|

Sunroof 03/05/21 2:32:28 PM #1: |

Get through the blood bath. Invest now if you have any liquid cash!

... Copied to Clipboard!

|

|

GameStonk 03/05/21 2:33:18 PM #2: |

Decided that I won't check my account for a week. Let me know if we have good news, gang.

... Copied to Clipboard!

|

|

red sox 777 03/05/21 2:33:59 PM #3: |

It hasn't been such a dramatic shift before. Nasdaq has swung nearly 500 points trough to peak.

--- September 1, 2003; November 4, 2007; September 2, 2013 Congratulations to DP Oblivion in the Guru Contest! ... Copied to Clipboard!

|

|

Colegreen_c12 03/05/21 2:34:05 PM #4: |

tag

--- DPOblivion beat us all. ... Copied to Clipboard!

|

|

red sox 777 03/05/21 2:35:31 PM #5: |

Also, Moonroof, your patience has been rewarded. Make sure you're aware EVRI has earnings next week - I'd be pretty scared of holding through that with 100k in it.

--- September 1, 2003; November 4, 2007; September 2, 2013 Congratulations to DP Oblivion in the Guru Contest! ... Copied to Clipboard!

|

|

Sunroof 03/05/21 2:44:02 PM #6: |

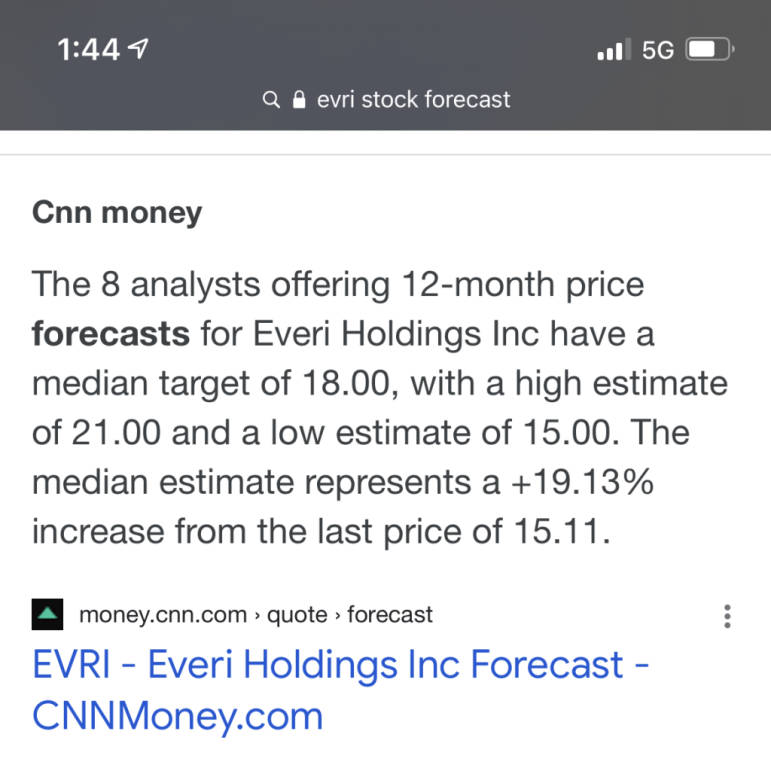

Yeah I was cognizant of that when I made the purchase yesterday. I really thought the market would rebound today. So I guess now I have to hope for it to rebound Monday. Although, EVRIs one year forecast is incredibly bright.

... Copied to Clipboard!

|

|

Sunroof 03/05/21 2:44:41 PM #7: |

Even the low is higher than what I bought it at and what it is right now! Even the low is higher than what I bought it at and what it is right now!... Copied to Clipboard!

|

|

Colegreen_c12 03/05/21 2:45:38 PM #8: |

Sunroof posted...

Yeah I was cognizant of that when I made the purchase yesterday. I really thought the market would rebound today. So I guess now I have to hope for it to rebound tomorrow. Although, EVRIs one year forecast is incredibly bright. It might be hard for it to rebound tommorow =P --- DPOblivion beat us all. ... Copied to Clipboard!

|

|

Sunroof 03/05/21 2:47:52 PM #9: |

I meant Monday! Earnings are Tuesday after hours.

... Copied to Clipboard!

|

|

ExThaNemesis 03/05/21 2:48:03 PM #10: |

Red sox, you taking profits like an intelligent person had nothing to do with why the infinite squeeze didn't happen. Zero. That was all the brokerages shutting down when they did.

--- "undertale hangs out with mido" - ZFS Smash Ultimate Switch Code: SW-6933-1523-8505 ... Copied to Clipboard!

|

|

StartTheMachine 03/05/21 2:52:40 PM #11: |

I still think AMC probably would have actually run to 50 or close if that didn't happen. And I would've had around a 200k trade, hot damn.

--- - Blur - Welcome to your Divinity. ... Copied to Clipboard!

|

|

Lopen 03/05/21 2:58:04 PM #12: |

Decided to add more FUBO but did it in the colegreen approved way of selling puts on it.

Being pretty aggressive and selling the $29 (3/12 exp) though. --- No problem! This is a cute and pop genocide of love! ... Copied to Clipboard!

|

|

Sunroof 03/05/21 3:02:10 PM #13: |

Wow homie stock EVRI is almost green for the day. What an absolute baller. Cant believe I wimped put and didnt put more in at $13 and change.

... Copied to Clipboard!

|

|

Colegreen_c12 03/05/21 3:03:19 PM #14: |

$29 3/12 is a little aggressive but not too bad since its only a week out and worst case you can just roll it next week if needed

--- DPOblivion beat us all. ... Copied to Clipboard!

|

|

Lopen 03/05/21 3:12:07 PM #15: |

I just see the absolute bottom at around $25 currently given what it has on the table. Possible the market collapses some more next week and it goes below what I feel is the bottom but I have no problem holding (or rolling the put out a bit) it if it does. Market will bounce eventually I'll get my delicious sold call money when it does.

--- No problem! This is a cute and pop genocide of love! ... Copied to Clipboard!

|

|

Colegreen_c12 03/05/21 3:15:13 PM #16: |

yea i think a cost basis of 26 or below is free money. 27-28 is still basically free money but you might need to hold a few weeks

--- DPOblivion beat us all. ... Copied to Clipboard!

|

|

TheCodeisBosco 03/05/21 3:53:39 PM #17: |

I hope you held some TA with me, Moonroof!

I've found solace during this bloodbath by grabbing all the WING I can on the dip. I really think it'll have a strong recovery once the stimulus gets rolling. --- The music was thud-like. The music was... thud-like. ... Copied to Clipboard!

|

|

Sunroof 03/05/21 3:55:11 PM #18: |

I didnt :(

I sold on Tuesday (twice) for $1k. To have enjoyed todays rebound I would have had to have bought end of day yesterday. ... Copied to Clipboard!

|

|

Sunroof 03/05/21 3:55:39 PM #19: |

It still looks like it has a ton of space to make up though

... Copied to Clipboard!

|

|

Lopen 03/05/21 4:02:04 PM #20: |

Yay finished green on the day +$300

--- No problem! This is a cute and pop genocide of love! ... Copied to Clipboard!

|

|

Sunroof 03/05/21 4:04:21 PM #21: |

No idea what to expect for Monday. We finished today higher than what we started yesterday.

... Copied to Clipboard!

|

|

red sox 777 03/05/21 4:18:25 PM #22: |

Still ended up a bit in the red for the day. Feeling positive though. I think that may have been the bottom.

--- September 1, 2003; November 4, 2007; September 2, 2013 Congratulations to DP Oblivion in the Guru Contest! ... Copied to Clipboard!

|

|

CoolCly 03/05/21 4:28:05 PM #23: |

quite the end of day rally. Everything I had except my VOO Vanguard ETF was very red all day including my ARK etf's but a lot of it turned green at the end there.

--- The batman villians all seem to be one big joke that batman refuses to laugh at - SantaRPG ... Copied to Clipboard!

|

|

Sunroof 03/05/21 4:31:47 PM #24: |

Im believably, the Dow is so high right now that I wouldnt be surprised if it dips next week. Not the point of its lows from this week, but somewhere between there and where it is now.

As for the NASDAQ, I think more red days are coming. It had a damn near year of solid gains, after all. A correction has been brewing for a long time. ... Copied to Clipboard!

|

|

StartTheMachine 03/05/21 5:04:45 PM #25: |

Stimmy bull run coming next week that let's me exit all my positions with very modest profits, so I can watch and await the extra juicy dips from another month of pain. Because there will be more.

This is all I want. And AVCTW to keep going down. Lowest I saw was .65, still not in line with commons. --- - Blur - Welcome to your Divinity. ... Copied to Clipboard!

|

|

Sunroof 03/05/21 5:12:20 PM #26: |

I thought the market already reacted from the stimulus getting passed?

... Copied to Clipboard!

|

|

Menji 03/05/21 5:41:36 PM #27: |

It hasn't passed yet.

I recall for the last two, the market didn't react until they were actually passed --- Menji+ https://imgur.com/F5UEyUw | https://imgur.com/pPZsSZU Congrats to azuarc! [ https://myanimelist.net/profile/Menjii ] ... Copied to Clipboard!

|

|

Sunroof 03/05/21 6:04:41 PM #28: |

Okay, cool. I dont feel so paranoid then for still holding EVRI and BUZZ.

... Copied to Clipboard!

|

|

ExThaNemesis 03/05/21 6:53:58 PM #29: |

When exactly did the bull run post stimulus hit, and how long did the previous two last.

Trying to chart the next GME moonshot so I can get out this time lmao --- "undertale hangs out with mido" - ZFS Smash Ultimate Switch Code: SW-6933-1523-8505 ... Copied to Clipboard!

|

|

red sox 777 03/05/21 7:11:35 PM #30: |

IMO the movement in GME from Feb 24 - today looks very similar to its movement from Jan 13 - Jan 21. An initial spike from a gamma squeeze followed by a descent and then a gradual rise in the price while volume steadily declines.

GME has not been correlated with the market though - has inversed the market if anything. --- September 1, 2003; November 4, 2007; September 2, 2013 Congratulations to DP Oblivion in the Guru Contest! ... Copied to Clipboard!

|

|

Lopen 03/05/21 7:24:01 PM #31: |

Maybe Nanis should put money into GME instead of SQQQ

--- No problem! This is a cute and pop genocide of love! ... Copied to Clipboard!

|

|

StartTheMachine 03/05/21 7:24:39 PM #32: |

Yeah if the market bull runs GME probably flops.

Also GME short interest is a joke now. The whole thing is a cult to me at this point but good luck to anyone in it. Hope I don't miss the opportunity to buy (more reasonable) puts this time. --- - Blur - Welcome to your Divinity. ... Copied to Clipboard!

|

|

red sox 777 03/05/21 7:33:59 PM #33: |

StartTheMachine posted...

Yeah if the market bull runs GME probably flops. It's still one of, if not the, most shorted stock on the market by percentage of the float shorted. And probably there are a significant number of naked calls, which are functionally the same thing as shorts. I would suggest not betting against a cult. Tesla bears have been doing that for 10 years and getting crushed. Their problem is that once a stock has a sufficiently strong cult it really doesn't matter what the rest of the world thinks. The cult can even save the company - and that is what happened with Tesla, which probably goes bankrupt if not for the shareholders willing to pony up more money to keep the company afloat while it was losing money. That happened with AMC which was looking at possible imminent bankruptcy. It could have happened with Hertz if they could have just held off on the bankruptcy filing just a few more weeks last year. --- September 1, 2003; November 4, 2007; September 2, 2013 Congratulations to DP Oblivion in the Guru Contest! ... Copied to Clipboard!

|

|

StartTheMachine 03/05/21 8:12:24 PM #34: |

I've been watching Meet Kevin, the YouTuber, stream market close where he often takes a look at shorted stocks via Reuters and Bloomberg Terminals. Those things require like $700 - $1800 a month subscription but obviously whales like him and institutions find it useful to have the most up to date information. But you can just watch his YouTube channel and get the information too!

IIRC GME's short float was around 15% a couple days ago, though maybe it has increased since then. TD is saying 30%, but again, Reuters has exact up to date information and is what all the institutions use. CCIV, by comparison, was 47%, over triple the short interest. So yeah, it's nowhere near the most shorted stock on the market anymore, but it's not anything to sneeze at either. Just relative to 140% short interest, it's a joke. I'll watch his latest stream and see if he doesn't check GME again and get more accurate figures. It could have gone up again. Now the cult point is one I absolutely agree with, and is why I'd buy puts at least a few months out to be safe. --- - Blur - Welcome to your Divinity. ... Copied to Clipboard!

|

|

red sox 777 03/05/21 9:15:12 PM #35: |

S3 Partners had GME's short interest at 28% as of yesterday which is in line with what I've been seeing since shortly after the end of the first squeeze. 15% seems really dissonant with that, although I suspect it has to do with how it's calculated - maybe they are dividing by total shares instead of float? IDK.

But I think the technical short interest may not be that big a driver here. The number of call options is apparently very high. For instance, there are call options representing over 700k shares with a strike price of $800 expiring next Friday alone. That is like 1% of the float for one deep OTM weekly call strike price. --- September 1, 2003; November 4, 2007; September 2, 2013 Congratulations to DP Oblivion in the Guru Contest! ... Copied to Clipboard!

|

|

red sox 777 03/05/21 10:18:00 PM #36: |

So I did some digging. There are currently 1,992,096 open GME options through January 2023. Most of these are short term options that expire by April 2021. If half of them are calls, and all of the open calls are exercised, this represents an obligation for the call writers to sell approximately 100 million shares. There are less than 70 million outstanding shares of GME, of which only about 45 million shares are in the float.

It is mathematically impossible for anything close to all of these calls to be covered with shares. Indeed, I would guess a large percentage of GME shareholders are not writing calls against their shares. The only way the calls could be properly covered would then be with other calls. Which is possible, but this level of options activity looks unusual. I did a quick check with F and SPCE as a gut check - F had about 5% of the float as call interest (assuming half the options are calls) and SPCE had about 20% of the float as call interest (again assuming half the options are calls). Whereas GME looks to have about 220% of the float in calls. F and SPCE are fairly active stocks so I don't think my comparison should be too off base but if there are other stocks with anything like 200% of the float committed to calls, I'd be very interest to know that. Did another gut check - AMC is at about 30% using the above analysis. So yeah, nothing like GME's 220%. --- September 1, 2003; November 4, 2007; September 2, 2013 Congratulations to DP Oblivion in the Guru Contest! ... Copied to Clipboard!

|

|

StartTheMachine 03/05/21 11:28:35 PM #37: |

Lmao this is an actual ad I just got on YouTube

https://youtu.be/eWLtryFra2c I guess this is what happens when you transition from watching mostly gaming podcasts to mostly stock podcasts! I recommend the Millenial Money and Chamath's All In podcasts. --- - Blur - Welcome to your Divinity. ... Copied to Clipboard!

|

|

MajinZidane 03/05/21 11:30:37 PM #38: |

red sox 777 posted...

So I did some digging. There are currently 1,992,096 open GME options through January 2023. Most of these are short term options that expire by April 2021. If half of them are calls, and all of the open calls are exercised, this represents an obligation for the call writers to sell approximately 100 million shares. There are less than 70 million outstanding shares of GME, of which only about 45 million shares are in the float. Very interesting information. Are you just gathering this information, or have you drawn any conclusions based off of it? --- Virtue - "You don't need a reason to Boko United." ... Copied to Clipboard!

|

|

red sox 777 03/06/21 10:19:43 AM #39: |

MajinZidane posted...

Very interesting information. Are you just gathering this information, or have you drawn any conclusions based off of it? I don't know. What I really want to know is how many of those calls are properly hedged with other calls (like in a spread) and how many are naked. A single block of 100 shares could potentially support a long chain of calls. Like, A writes a call covered with shares. B buys the call and uses it to write another call at a different strike price or expiry date, using the first call as a hedge. C buys the second call and writes a third using the second as a hedge. And so on. Hard to tell how many layers deep the chains have gone. Also, supposing the chains are very deep and the calls are properly hedged, I'm not sure about how much chaos having this kind of leverage could have. Like, suppose Z is the end call buyer, and he decides to exercise his call. Y must now deliver shares he doesn't own, but he does own a call from X, so he exercises that call to obtain the shares he needs. X doesn't have the shares either, but he owns a call from W, so he exercises that one. And so on back to A, the only person in the chain who actually owns shares. In theory, this should work smoothly and in a theoretical world, from the point of view of A and Z they may not know that A was not directly selling his shares to Z. I suspect that either there are a significant number of naked calls or the chains of hedges are not working all that smoothly though, as GME has experienced rather a lot of gamma squeezes including that recent one that went from $50 to $200. That is an ultra rare event normally while for GME it's happened like 5ish times in 8 weeks. Where I'm having trouble is understanding the motive of the shorts in the world where they have sold many naked short calls. I would have much more confidence in a trade if I can come up with a reasonable motive for why someone on the other side of the trade would act the way they do. For example, with travel stocks last year, people sold because they were afraid and risk averse. They wanted stable investments in blue chip companies and they got companies losing billions per month due to a strange new pandemic we knew little about. So they sold out of fear, even though they got very poor value for their shares. They didn't care so much about the value because the stock had left the risk class they were comfortable with. They got to avoid the risk of travel companies going bankrupt, and people who bought got the benefit of earning that sweet risk premium. For GME, I have a hard time understanding why a fund would engage in what appears to be such a manifestly stupid trade like shorting GME, either directly or by writing calls, which would support the theory that maybe they are properly hedged. As a rule, if you are thinking that "the other guy is stupid" that is a big red flag that you are the one who is missing something. The best I can think of as a rationale for them in the world where they aren't close to properly hedged is that the hedge funds doing this really believe that retail traders are stupid. That, or the people managing the funds aren't really concerned about losing money for their investors because it doesn't make much difference to how much the managers make whether they come in slightly under their hurdle rate or lose 50% of equity under management - they only care about gains, not losses, so they're happy to take on more risk without getting more risk premium. That, or our country's reaction to 2008 (bail out the big financial institutions) has trained a generation of finance people in the belief that the government is there to backstop them. I do find the resemblence of the Jan 13 - Jan 21 price and volume movement and the Feb 24 - now price and volume movement striking, and this trade remains asymmetric and incredibly interesting, so it's worth having some money in it to me. I follow the Kelly Criterion pretty strictly so the asymmetric nature of the trade is also a reason not to put a lot of money in it. --- September 1, 2003; November 4, 2007; September 2, 2013 Congratulations to DP Oblivion in the Guru Contest! ... Copied to Clipboard!

|

|

Sunroof 03/06/21 12:20:27 PM #40: |

Ive grown to absolutely loathe Geminis interface so I sold all my crypto. Only made about 4% gain. Im considering going back to Coinbase but I dont know. For now, Im just putting that money back into my Vanguard account.

... Copied to Clipboard!

|

|

GameStonk 03/06/21 12:26:48 PM #41: |

Sunroof posted...

Ive grown to absolutely loathe Geminis interface so I sold all my crypto. Only made about 4% gain. Im considering going back to Coinbase but I dont know. For now, Im just putting that money back into my Vanguard account.You SOLD your crypto because you didn't like the UI? Baller move! ... Copied to Clipboard!

|

|

Sunroof 03/06/21 12:29:15 PM #42: |

Do you have any idea how suave I am?

... Copied to Clipboard!

|

|

DoomTheGyarados 03/06/21 12:36:18 PM #43: |

Stocks this week: Blood red

Pokemon this week: +12,600 Join me. --- Sir Chris Doom The Kanto Saga - Animated Series - https://www.youtube.com/watch?v=6hH4wNFCrLM ... Copied to Clipboard!

|

|

GameStonk 03/06/21 12:39:31 PM #44: |

DoomTheGyarados posted...

Stocks this week: Blood redChris, how often do you sell and how do you know when to sell? I would figure that something like collectibles really only ever go up in value, unlike stocks ... Copied to Clipboard!

|

|

neonreaper 03/06/21 12:43:28 PM #45: |

*thinks about selling his baseball cards for 100 dollars when they used to be worth thousands*

--- Donny: Are they gonna hurt us, Walter? Walter: No, Donny. These men are cowards. ... Copied to Clipboard!

|

|

DoomTheGyarados 03/06/21 12:45:31 PM #46: |

Well basically I like to keep a velocity of money in my business, so there are some things I may be likely to pass on to my kid for his future in terms of "never sell."

But basically outside of my big winners (PSA 10 retro cards, vintage sealed product) I have this basic method: I buy things for MSRP and see how the market goes. An example of this is the "Hidden Fates" set that released 2 years ago. I bought over 30,000 dollars worth of that for -15% of MSRP from a bulk retailer. So these tins that came with 4 packs and promos retailed for 20, I was paying 17 per because I let them open the tins and just send me the promo cards and packs (saves them a shit ton on shipping) So anyway those tins now go for 60 dollars each or so, meaning that the cards inside are worth a lot more. So then I send them in for grading. A PSA 10 is worth about 2.5 times a raw card is usually for new sets. So if something is worth 100 raw a PSA 10 would get me 250 while a PSA 9 would get me like 175-200 probably. So a card that may have been worth 30 is now worth 90 raw and is nor worth 160-250 graded. Because of that I know I am making a good deal of money on that card. Also certain cards tend not to inflate as much. Charizards inflate because everyone loves them, so those I am often times hesitate to sell. Lots of different factors basically but yeah I could realistically hold forever, but my process of diversifying is selling my "stock" of a card and reinvesting it in newer or older sets and obtaining variety basically. --- Sir Chris Doom The Kanto Saga - Animated Series - https://www.youtube.com/watch?v=6hH4wNFCrLM ... Copied to Clipboard!

|

|

Sunroof 03/06/21 1:05:45 PM #47: |

I feel like to truly maximize Pokmon card (or any tangible commodity) profits, youd have to buy such a bulk amount on the front-end that itd be impractical to do it casually. In other words, youd have to have a business in which said commodity was your trade.

... Copied to Clipboard!

|

|

Sunroof 03/06/21 1:06:27 PM #48: |

Also, the Senate just passed the stimulus package! Now we just need the House to and I believe thats that.

... Copied to Clipboard!

|

|

DoomTheGyarados 03/06/21 1:07:27 PM #49: |

Not really, some of it yeah but for example if you buy premium collections at MSRP those will go up in value. Never has not. I bought a 80 dollar premium collection 2 years ago that now goes for 700 as an example. Elite Trainer Boxes are another hot collectable as an example.

Just got to know what to look for, but obviously I do buy bulk. --- Sir Chris Doom The Kanto Saga - Animated Series - https://www.youtube.com/watch?v=6hH4wNFCrLM ... Copied to Clipboard!

|

|

Sunroof 03/06/21 1:08:34 PM #50: |

But whos gonna spend $80 to make $$620 in two years? And I feel like thats probably a super unlikely profit to get a lot of the time.

... Copied to Clipboard!

|

| Topic List |