Lurker > Zachnorn

LurkerFAQs, Active DB, DB1, DB2, DB3, DB4, DB5, DB6, DB7, Database 8 ( 02.18.2021-09-28-2021 ), DB9, DB10, DB11, DB12, Clear

| Board List | |

|---|---|

| Topic | Stock Topic 26 |

| Zachnorn 03/26/21 9:38:59 AM #54 | neonreaper posted... why is ATNF up so big that I can now buy a car with itI've been seeing some chatter on r/WallStreetBets about it --- <D |

| Topic | Stock Topic 26 |

| Zachnorn 03/25/21 8:43:03 PM #52 | That makes sense. My losses might have been bad timing as the market isn't looking so bullish anymore. I have positions I'm holding for the long term, but if the market has more major dips, I might end up selling when I see they're at a high. I'm kind of concerned about this becoming a bear market for a lot of 2021, because soon there will be normalcy and fewer people wanting to throw money at stocks. At least, I think part of the reason why stocks have done so well is because of a lot of retail traders that suddenly had time and resources to play with stocks (can't take that vacation? Might as well put it in stocks!) and when they can do normal activities, they'll sell some stocks to pay for that. If the market dips, some retail traders will probably want to cash out. I don't know, just kinda feeling that stocks are overvalued in general right now compared to how the economy is performing during the pandemic.That's why I'm really thinking I have ETFs long term and stocks short term, if I don't exit the market. --- <D |

| Topic | Stock Topic 26 |

| Zachnorn 03/25/21 7:53:33 PM #50 | red sox 777 posted... Going back to this, I would suggest not setting stop losses, basically ever. If you think a stock is a good investment at a certain price, why would it be a good sell at a price 7% lower? Unless you think something has changed about the company or the market, the price going down is a reason to buy, not sell.I have two types of stocks in my portfolio: Serious investments (80%), and gambles/memes (20%). My serious investments like QQQ, QQQJ, DIA, DIS, ACI, etc., don't have 7% stop losses. The only one that has reached that level before was QQQ, which I kept and averaged down and plan to hold. The problem is that I gamble and haven't used stop losses. In trying to make about $30 in BYND and not being willing to take a loss, my expected loss (if I were to lose on my bet) of maybe $30 within a month turned into $300 because I kept averaging down. I think I could have faced a $50-80 loss if I did a 7% stop loss. That said, I did use a stop loss today in a gamble/meme stock, and I learned this lesson: red sox 777 posted... With a stop loss, you will likely lose the amount of the stop loss on most trades, and 5-7% itself is not that big, but repeat a few times and it can become quite big. You can lose money even while the stocks you are investing in are flat or even going up, because you are missing out on the gains while eating the losses.I set up a conditional trailing stop limit order such that if GME goes above $150, an order gets sent for a trailing stop of -2% and a limit of $150. I was expecting it to go further than it did, hopefully up to the $161 that I paid, but that didn't happen - it just saved me from larger losses had I given up earlier in the morning. It sold for $150. I could have gotten $185 later on and made money instead of losing $11. That's an $11 lesson, I guess, and I'm going to remove a similar order for closing BYND. red sox 777 posted... Stocks falling 15-25% is normal. Warren Buffett has said (paraphrasing) that if you aren't emotionally able to handle a 50% drop in your stocks, investing probably isn't for you.I'm not sure if I have the opposite problem in that I'm a gambler and found a way to gamble without driving to a casino and have way better odds at the same time. --- <D |

| Topic | Stock Topic 26 |

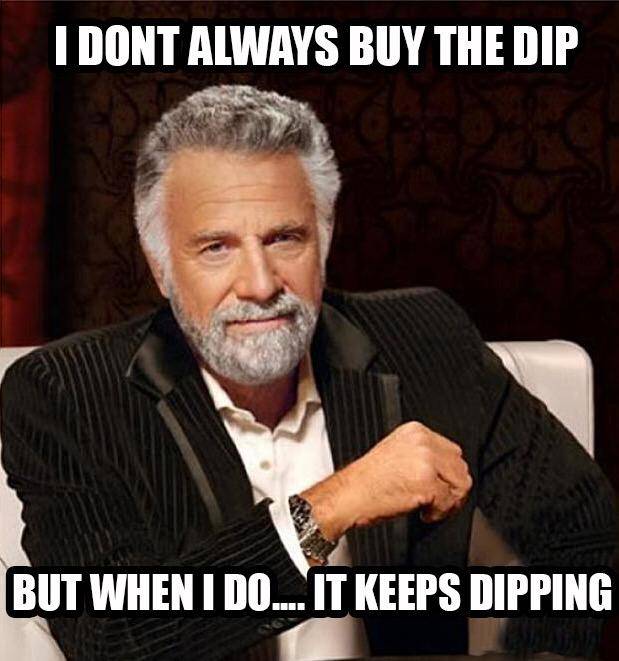

| Zachnorn 03/25/21 9:55:49 AM #22 |  --- <D |

| Topic | Stock Topic 26 |

| Zachnorn 03/25/21 7:52:28 AM #3 | I'm considering putting in another 4k into my account and buying up some of these NASDAQ stocks while they're cheap and setting up 5-7% stop losses in case they drop too much more. Looking at my portfolio, my losers that wiped out my gains in other stocks were the ones I didn't put such a stop loss in so they fell 15-25%. I don't understand options and don't want to play with something I don't understand yet. "Buy low, sell high, get dividends if you own it long enough" is something my small stock market brain can understand though. --- <D |

| Topic | Stock Topic 25 |

| Zachnorn 03/24/21 4:24:44 PM #447 | DoomTheGyarados posted... buy disney. don't gambleWhat's funny is that a few months ago, I sold Disney and among the things I bought, I bought meme stocks. With that said, memes make up a small part of my portfolio now. Of what I have left of AMC and GME, it's less than $150 of a $5,400 portfolio. Most of my money is in ETFs like QQQ, VOO, and SPY. I bought a bunch of QQQJ today because it dropped again to about $31.60 when I bought it (now $31.36). I'm seeing it go in cycles and I'm hoping I can sell it when it eventually goes back up to $33 again. Already set a conditional trailing stop limit order to sell half at > $33. --- <D |

| Topic | Stock Topic 25 |

| Zachnorn 03/24/21 3:40:12 PM #441 | Yikes, I haven't had this much of a drop in portfolio value since I started 2 months ago. This is also my first time playing with GME and I'm down $37. Might as well hold, though. I gambled on AMC and won like $45 and I guess most of it is being lost on GME. --- <D |

| Topic | Stock Topic 25 |

| Zachnorn 03/24/21 9:41:55 AM #428 | After a while of serious investing, I decided to go take a gamble on GME today. Only one share. Currently down by $5. This is more fun than losing $5 on a hand of blackjack, so it's fine. Interesting to see how volatile this is. --- <D |

| Board List |