Lurker > Zachnorn

LurkerFAQs, Active DB, DB1, DB2, DB3, DB4, DB5, DB6, DB7, Database 8 ( 02.18.2021-09-28-2021 ), DB9, DB10, DB11, DB12, Clear

| Board List | |

|---|---|

| Topic | Stock Topic 29 |

| Zachnorn 05/12/21 7:41:03 PM #163 |  --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/12/21 4:03:19 PM #157 | And that's my biggest one day fall, over $300. I also didn't say this today so I will now: ow my portfolio --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/12/21 2:03:01 PM #155 | On red days, it seems like I can basically rely on AMC to still make a profit. I need to put more money into it when it drops again. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/12/21 11:25:49 AM #150 | True. Makes me wonder if I should buy more stock, but it is/was (as it lost over a third of its value) a big part of my portfolio already. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/12/21 11:18:14 AM #148 | Lopen posted... Yesterday I had lost $10k on FUBOThis has been my logic as well, which has led me to sell things that are still profitable and hold things that lose money. Been trying to think of how to improve my strategy. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/12/21 10:32:51 AM #145 | Lopen posted... Diamond handz. Believe in your stock and it'll believe in youBut I've believed in BYND for 3 months and I've lost $485 on it I played with FUBO and am down about $1 as well. Oh well, that's what I get for gambling. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/12/21 10:17:32 AM #142 | BYND announced new products today, plant-based meatballs. There's also an expanded presense at Walmart. This is great news for the company. My stock is down 2.54%. This is my most frustrating stock with the most losses. I'm holding but this is so annoying. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/11/21 6:40:39 PM #137 | I have access to afterhours trading and I'm wondering if I should get in on FUBO even if I missed out on the earlier sharp gain. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/11/21 1:25:22 PM #131 | Supposedly, the best portfolios are the ones you forgot you had for like a decade and then go "oh yeah I have this old account" and then you see you gained a lot of money. Happened to someone that bought a bunch of GameStop in like 2003 and then forgot about it until the GME short sqeeze this year. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/11/21 12:50:50 PM #129 | ow my portfolio --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/11/21 9:26:24 AM #125 | DoomTheGyarados posted... Ugly across the board means time to buyMaking my first order on my new Roth IRA account! This is my M1 pie for it. https://m1.finance/TwwY5IbbA_ZI --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/11/21 8:55:43 AM #121 | I opened up my brokerage app and this is ugly. The market isn't even open yet and this is flat out scary. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/10/21 5:11:26 PM #119 | LordOfDabu posted... I had the moral stock debate with myself earlier today, although for something less offensive. Mine was on the "homework help" website chegg (CHGG)I think when investing in individual companies, you have to be neutral about the company. Hating the company can make you think emotionally when it comes to buying and selling. ChainLTTP posted... All this talk about stock morality is making me want to buy the Big Tobacco dip (no pun intended)I may hate the tobacco industry, but I can't deny that it has good dividends. You'd get a good yield. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/10/21 4:27:19 PM #117 | I kinda want to get back into GVSI but the moment I do, it will drop 30% --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/10/21 1:22:29 PM #98 | Peace___Frog posted... ETFs are difficult because everyone's moral bar is different, and what others are comfortable with I am not. I try to avoid most of the tech giants, which admittedly makes things far more difficult than they would be otherwise. I'm sure I could earn more and not have to be so picky.I guess the best thing to do is to do your best to avoid investing too much into them. Like I'm obvious going to do it if I'm investing in one of those whole stock market ETFs like VTI. I may hate certain industries, but I can't pick and choose companies to exclude when I buy an ETF. So I guess it's good to donate to a cause contrary to what the company you hate does or believes. Like if you're investing in companies that pollute heavily and only because it's in an ETF, you could donate your profits to a charity that works to stop climate change, for example. Metal_DK posted... Gvsi doin work to keep things green todayDamn it why do I sell my stocks --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/10/21 12:01:37 PM #92 | Sunroof posted... Its just business. No need to feel badly but if its bothering you then you can switch out.Yeah, that's the thing about business for me, I guess. I have a degree in business, but the funny thing is, there's a lot about business I dislike. Part of why I work in the public sector now. ChainLTTP posted... If you're going to feel this way then you probably shouldn't put your money into any ETFs. Will be nearly impossible to avoid.True, though there are some ETFs that exclude certain industries and I might buy some of those ETFs. Alternatively, I might just donate whatever profit I earned from companies I morally disagree with into organizations that oppose or deal with the damage those companies caused. I guess at minimum, I don't want to keep whatever money I get that I see as blood money; I'd rather see it go and do something positive. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/10/21 12:15:26 AM #83 | I'm conflicted morally. I have an ETF that has a high (not that high, but over 3%) weight in an industry (that I won't mention for now) that I'm morally against. I feel like I'm benefitting an industry I hate and some of the money I'm getting from it is blood money. Is it silly for me to feel this way? Would it be dumb to sell the ETF when it's been one of my better performing ETFs? --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/09/21 11:51:31 PM #80 | I honestly don't know what works anymore. I invested in a "conservative" portfolio on SoFi and I lost 1% of the value and only now recovered. Thankfully, it was 1% of $100 I was playing with. I'm going to pull out some money from the stock market as I'm feeling bearish. My long term strategy is to dollar cost average for a while. I'm still considering buying a condo in LA and I see some that I can more easily afford now. So I'm thinking of sticking with safer investments except in a Roth IRA in case I need to strike on real estate. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/09/21 4:51:13 PM #72 | Elon Musk is at it again. https://www.cnbc.com/2021/05/09/spacex-accepts-dogecoin-payment-for-doge-1-mission-to-the-moon.html --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/09/21 12:39:50 AM #47 | There's a reason why I call it RobTheHood. Anyway, I sold my Dogecoin earlier for like $2 profit. Would have made a loss if I sold now. Only bought $50 of it. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/07/21 6:35:47 PM #4 | It's definitely overhyped. SNL is not going to be an explosion for Dogecoin. I don't think Elon Musk can really use it as a platform to suggest an investment and I don't imagine that the people that are watching would care enough to put money into it. --- <D |

| Topic | Stock Topic 29 |

| Zachnorn 05/07/21 6:17:43 PM #2 | Dogecoin at $420.69. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/07/21 6:07:34 PM #497 | I wanted to buy like $50 in Doge in February. Imagine if I did. Of course, I say that but I know I would have sold it at 10 cents per Dogecoin. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/07/21 6:03:53 PM #494 | much wow I bought 80 a few days ago. I used Robinhood for it because it was the only one that let me trade with unsettled funds and I feel so dirty for it. I can't wait for my funds to settle in Webull so I can trade crypto there. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/07/21 2:32:45 PM #482 | BYND was the first stock I put over $1,000 into and I've lost $455 so far. Hurts. Holding I guess, because I think it will go back up and I want to have maybe a $200-$300 loss at this point. I might buy more but it feels like it's too big in my portfolio for how awful it has been performing. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/07/21 2:23:41 PM #478 | I'm still recovering from this past week. I not only lost all my gains this year, but also have $15 less than I started with. Which is better than when I was $120 less than what I started with. But yikes, the earnings calls on BYND, RKT, and VIAC wrecked me. The latter two were good earnings too! --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/06/21 5:23:32 PM #468 | Probably going to buy some GS. It does look like a good stock. I'm looking to buy some ETFs though. More SCHD probably, though that is already my biggest ETF in terms of the value of what I own. I'm noticing that my dividend stocks/ETFs are going up, SCHD included. During the Great Depression and following the crash, it was thought that only dividend stocks provided any value. I wonder if that's becoming the sentiment or if I'm just not looking this over properly because my speculative stocks tend to not have dividends. That said, I'm shocked that I've had almost 13% returns on AT&T (T) since I bought it in February. I wish I bought more of it, I really like the stock and I got it because of dividends. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/06/21 4:30:29 PM #465 | I just need to repeat this. Zachnorn posted... Ow my portfolio Lost a lot today. I've sold off my QQQ and VTI. I don't have faith in the NASDAQ or speculative stocks at this point and expect temporary damage to the stock market. I think some of my losses will rebound partially, but I'm probably going to sell them off once they do, even for a loss. Then focus on long term investments. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/06/21 1:47:03 PM #463 | Sunroof posted... The Dow has been going up. Not sure what you guys are panicking for. Maybe the particular stocks you are in are associated with people more likely to want to buy crypto.Probably. My losses today are in these: BYND RKT VIAC DIS QQQJ FIVE VTI AMC Aside from Disney, QQQJ, VTI, and maybe Five Below all of these are speculative stocks. Exactly the type that would get pushed up by retail traders earlier and then decline when they go into crypto. Speaking of, I now own $50 of Dogecoin because I'm a gambler at heart. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/06/21 11:27:09 AM #454 | Also I invested in RKT and VIAC and both had great earnings. They're down 15% and 2.81% for me, respectfully. I'm not optimistic about the stock market right now. --- <D |

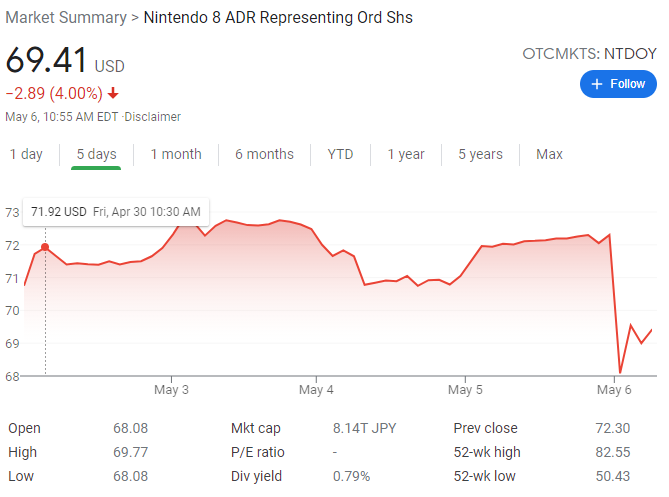

| Topic | Nintendo fiscal year too much yen |

| Zachnorn 05/06/21 11:22:27 AM #14 | NFUN posted... people were just trying to get the price to $69.420Nice. --- <D |

| Topic | Nintendo fiscal year too much yen |

| Zachnorn 05/06/21 11:12:34 AM #12 | I bet Nintendo stock is doing very well due to this news! ...oh. I think this is why I don't quite understand the stock market sometimes.  --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/06/21 10:04:51 AM #452 | Ow my portfolio --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/05/21 9:06:01 PM #447 | StartTheMachine posted... Zachnorn you know that bitcoin is now worth about $60,000 and not $6,000 right neonreaper posted... He had 11 bitcoin cents I thinkThis. I never owned a whole Bitcoin, only 0.11something of one --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/05/21 6:15:41 PM #439 | Sell it on Saturday night. Or heck, who knows if people not already into investing will buy it because of Elon Musk's appearance. Consider selling some on Friday or early Saturday. Basically, his appearance on SNL might be overhyped as being a good thing for Dogecoin. Elon Musk is a big deal for people into stocks and crypto, but would any comments or jokes about Dogecoin really inspire the average person watching SNL to buy Dogecoin? I'm expecting a bump and then a significant selloff. I think a lot of investors are hyped, but there's not going to be as many buyers as people think there will be. That said I've been wrong about crypto stuff for the past decade and sold my Bitcoin in 2011 for $1 (now worth about $6,000) so there's that. --- <D |

| Topic | The "standard work day" really needs to be shorter |

| Zachnorn 05/05/21 3:55:16 PM #13 | Conner4REAL posted... If you dont like the length of your day work part time.I do something like this. I work for a school district so I have lots of time off. But when I do work a normal week without a holiday/break, I work 40 hours 5 days per week. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/05/21 1:04:32 PM #430 | Everyone's talking about crypto (especially Dogecoin) when it comes to Elon Musk going on SNL, but people forget that he also caused GME to spike up. And when GME spikes, AMC also follows. Bought some AMC. Considering buying GME as well. I wouldn't be surprised if he says something about GME and I feel like AMC is a safer stock than GME in general. At least, I have more faith in movie theaters than I do in brick and mortar video game stores. --- <D |

| Topic | The "standard work day" really needs to be shorter |

| Zachnorn 05/05/21 12:50:14 PM #7 | I'd be okay with a 10 hour day working 4 days per week. That cuts commuting and getting ready time dramatically. But what we really need is to have the work week cut to 30 hours. With the unemployment that we have and with how much productivity we squeeze from workers, we can afford to pay more per hour and cut hours to improve the quality of life. It's just not profitable to do that, so we don't do it. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/04/21 7:47:01 PM #407 | I wonder if I should invest in TulipCoin. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/04/21 4:29:29 PM #389 | Sunroof posted... My main thing is not losing money, more so than maximizing gains. Ive made nearly $200k YTD. I am trying to play it safe.And this is why I'm thinking of selling off a lot of stuff and going for cash to be held for either lots of buying in a crash or for other things. I'm also looking for safe investments. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/04/21 1:00:02 PM #365 | I really wish I held GVSI --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/04/21 11:40:55 AM #354 | masterplum posted... Amazingly SCHD where I park most of my money is even for the day.This and AT&T are the best recommendations I've had. I wish I put more in AT&T but I'm so glad that I put a lot of cash into SCHD. Thanks again for the recommendation. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/04/21 11:23:52 AM #351 | This is certainly my biggest drop as well. Is this the start of the crash? --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/04/21 9:51:45 AM #344 | All my stock market gains are gone and I've now lost money. Crypto makes no sense. I'm considering divesting and just letting my money sit in a high yield savings account and probably real estate (for me, not as an investment) until the markets start to make sense. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/04/21 9:42:31 AM #342 | I'm so pissed off that I couldn't get in on this because my accounts were broken. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/03/21 6:35:40 PM #322 | CaptainOfCrush posted... I'd say it's more of a day-trading topic. I don't like being that guy, but investments are generally seen as a more long-term concept.I alluded to this in the second part of my post as well. I'm also considering going into more long term investing. I've already invested in these stocks/ETFs for the long term: SCHD DIVO DIA VOO SPY (might sell due to it being similar/same as VOO) VTI DIS FIVE T Thoughts on these for long term stocks/ETFs? I also own these, but I've already sold off some and/or plan to soon: QQQ QQQJ AMC VIAC BYND ACI --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/03/21 3:42:05 PM #316 | I don't think it's accurate to call this the stocks topic. It's more of an investment topic. Which I'm not sure is accurate either because we're not talking about investing so much as trading. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/03/21 9:28:57 AM #289 | Peace___Frog posted... Haven't they pretty much always been doing this? The consolidation of real estate since 2008 is a known thingIt seems to be accelerating. We're seeing it get insane with cash offers and prices shooting up because of investors. Some markets have similar returns to the stock market (in a normal year) of about 10-12%. And they get rent on top of it. If they're not confident that stocks can get similar returns going forward, why not take money from stocks and put it in real estate? --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/03/21 5:18:47 AM #286 | Just going to point out that there were also a lot of new traders in the Dot Com Bubble as well. I really do think that once things open up that a lot of the people playing with stocks are going to get bored with it and not be as active. Or they want to sell to take their gains to finance their activities. There's real power in numbers. Retail traders can do great things, and GME, AMC, Dogecoin, and other meme stocks/crypto are evidence of that. But the average person is also fickle. I'm hoping that stocks aren't just a short term craze but I am considering the possibility that they are. It concerns me that a lot of rich and powerful people are taking money out of stocks and putting it in real estate. --- <D |

| Topic | Stock Topic 28 |

| Zachnorn 05/02/21 6:15:40 PM #275 | I tried to buy Dogecoin before the surge but it rejected me from doing it because I needed to verify but won't let me verify because I already did it. I just did it when the system was broken. Oh well. Maybe I should go for Webull. I've been considering it anyway. Of course, I already have a bunch of brokerage accounts at this point. Robinhood, TD Ameritrade, Fidelity, SoFi, M1...I gotta stop, my taxes are going to be complicated and annoying. --- <D |

| Board List |